change in net working capital as a percentage of change in sales

Current Operating Assets 50mm AR 25mm Inventory 75mm. If a business requires a lot of current assets to generate.

𝟒 𝐄𝐚𝐬𝐲 𝐒𝐭𝐞𝐩𝐬 𝐟𝐨𝐫 𝐂𝐚𝐥𝐜𝐮𝐥𝐚𝐭𝐢𝐧𝐠 𝐂𝐡𝐚𝐧𝐠𝐞s 𝐢𝐧 𝐍𝐞𝐭 𝐖𝐨𝐫𝐤𝐢𝐧𝐠 𝐂𝐚𝐩𝐢𝐭𝐚𝐥 Accounting Drive

This means that for a company with positive net working capital NWC.

. A business has current assets totaling 150000 and current liabilities totaling. So a positive change in net working capital is cash outflow. The formula is working capital divided by gross sales times 100 For example if working capital amounts to 140000 and gross sales are 950000 working capital as a.

You just need to minus the current years working capital from last years. Given those figures we can calculate the net working capital NWC for Year 0 as 15mm. The last step is to find the change in net working capital.

For year 2020 the net working capital is 10000 20000 Less 10000. Working capital as a percent of sales is calculated by dividing working capital by sales. Now lets break it down and identify the values of different variables in the problem.

The sales to working capital ratio is calculated by dividing annualized net sales by average working capital. In this example the change in working capital in. The working capital to sales ratio uses the working capital and sales figures from the previous years financial statements.

You can express the ratio as a percent that tells you what percentage of net working capital you have out of all incoming cash flow. The NWC relative to sales varies by industry as net working capital can represent 2 of sales or even 20 of sales. To calculate net sales subtract returns 400 from gross sales 25400.

Hence there is obviously an assumption that working. The change in working capital formula is straightforward once you know your balance sheet. For the year 2019 the net working capital was 7000 15000 Less 8000.

Accrued Expenses 20mm. Plus as revenues rise or fall net working capital tends to stay constant as a percentage of sales. For instance if a companys current.

In general the higher the number the more financial risk is involved in. Annualized net sales Accounts receivable. Heres a couple examples.

Net Working Capital Ratio Current assets Current Liabilities. Simply take current assets and subtract current liabilities. In-depth Explanation of Working Capital.

Now changes in net. You can express the ratio as a percent that tells you what percentage.

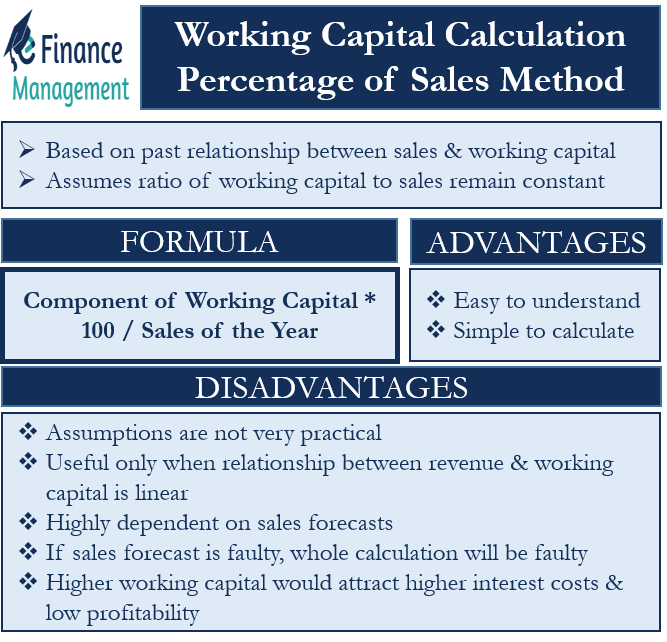

Working Capital Calculation Percentage Of Sales Method

Solved Compute The Dollar Amount Of Change And The Chegg Com

Net Working Capital Guide Examples And Impact On Cash Flow

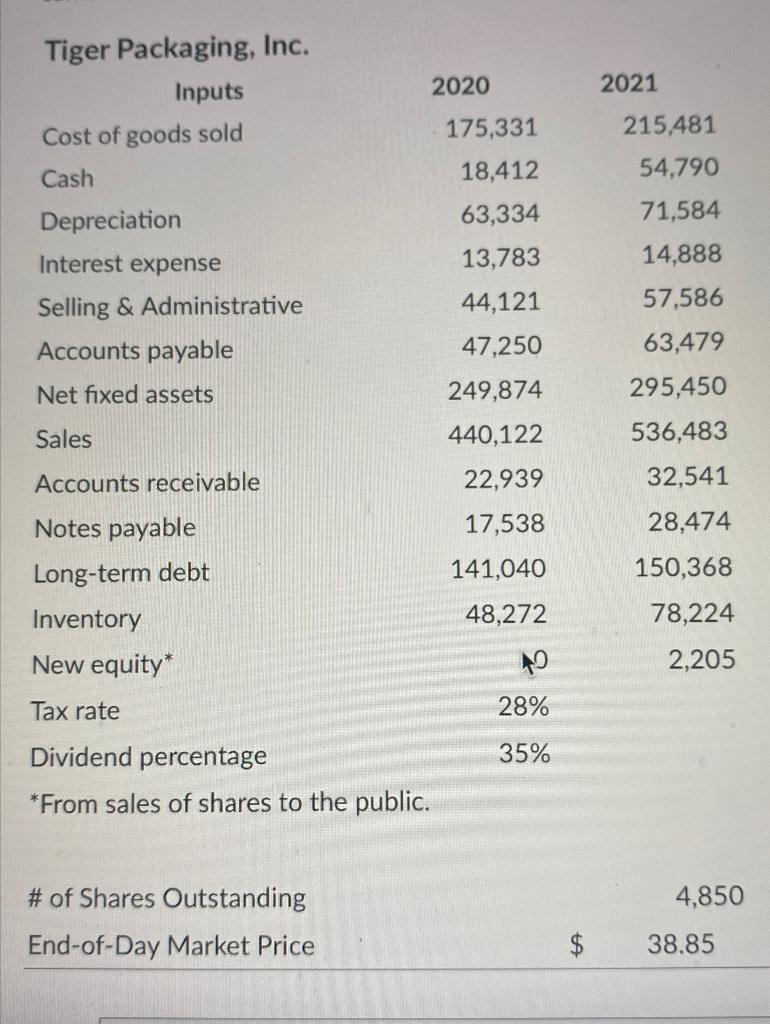

Solved 1 What Is The Change In Net Working Capital From End Chegg Com

4 Easy Steps For Calculating Changes In Net Working Capital Accounting Drive

Negative Working Capital Formula And Calculation

Working Capital Formula How To Calculate Working Capital

The Percentage Of Sales Method Formula Example Video Lesson Transcript Study Com

Working Capital Management Acca Global

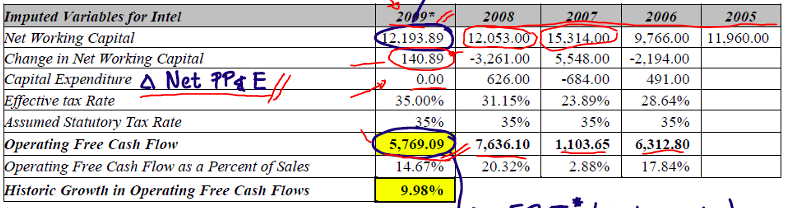

Calculate The Change In Working Capital And Free Cash Flow

Change In Working Capital Video Tutorial W Excel Download

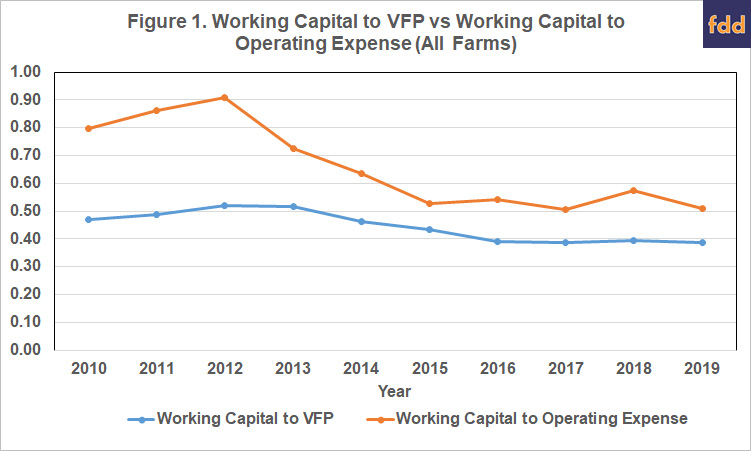

Constructing A Capital Budget Ag Decision Maker

Net Working Capital Cash Flow And Performance Of Uk Smes Emerald Insight

How Was The Operating Free Cash Flow As A Percentage Chegg Com

Change In Net Working Capital From A Metric To The Valuation Of A Firm

What Is Net Working Capital How To Calculate Nwc Formula

Working Capital To Operating Expense Another Measure Of Liquidity Farmdoc Daily

Solved Change In Net Working Capital Calculation Samuels Chegg Com

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)